China’s New Power Sector and its Changing Talent Needs

中国新能源市场现状及其人才需求分析

As a result of the war in Ukraine, European countries are looking to increase their energy security and independence. Amongst other things, this will mean increasing the focus on renewable and alternative energies.

俄乌战争的关系,欧洲国家正在寻求提高其能源安全和独立性的方案。除此之外,这也意味着市场增加了对可再生能源和替代能源的关注。

China, on the other hand, has so far been less affected by events in Europe. Global oil prices and record high natural gas prices are significant of course, yet the country’s energy policy remains largely unchanged. China is still committed to decarbonisation by 2060 and to capping carbon emissions by around 2030, and global events have had less of an obvious impact here than in other parts of the world.

另一方面,迄今为止,中国受俄乌战争的影响较小。全球油价和创纪录的高天然气价格在国际市场上意义重大,但中国的能源政策基本保持不变。中国仍致力于到 2060 年实现碳中和,并在 2030 年前后限制碳排放,战争对中国的影响不像世界其他地区那么明显。

For example, one area where there was already a great deal of excitement amongst Chinese investors was the ‘new power’ market. This goes beyond the likes of alternative energies such as solar, geothermal, or wind to industries such as batteries, fuel cells, and electric vehicles. These are all areas where China is taking a global lead, has seen significant levels of private equity investment, and has experienced stellar growth.

例如,中国投资者长久以来都非常热衷的一个领域是“新能源”市场。这不仅限于太阳能、地热或风能等替代能源,还涉及电池、燃料电池和电动汽车等行业。中国在这些领域都处于全球领先地位,私募股权投资规模显着,增长迅猛。

With this in mind, I’d like to take a deeper dive into three of the standout Chinese companies in these technologies to explore who is investing in them, why they have been so successful, and what these examples tell us about the rapidly-evolving market for senior-level talent in China.

鉴于新能源市场目前在中国的受关注程度,我想深入探讨在这些技术方面表现出色的三家中国公司,以探讨谁在投资它们,为什么它们如此成功,以及这些例子告诉我们的,关于快速发展的中国高层次人才市场的现状。

Contemporary Amperex Technology Ltd. (CATL)

宁德时代

Founded in 2011, CATL manufactures lithium-ion batteries for electric vehicles, and energy storage systems and battery management systems for a range of industries. The company grew rapidly to become the world’s largest lithium battery supplier by 2016, a position it has held every year since then.

宁德时代 成立于 2011 年,生产用于电动汽车的锂离子电池,以及用于一系列行业的储能系统和电池管理系统。到 2016 年,该公司迅速成长为全球最大的锂电池供应商,此后每年都保持这一地位。

CATL now supplies almost all of the largest Chinese and international car companies, including BMW, Mercedes-Benz, Changan, Volkswagen, SAIC, and NIO, amongst others. The company’s global market share in 2021 was 32.6%. As of the end of 2021, CATL’s market value had reached RMB 1.37 trillion (c. $215 billion).

宁德时代现在为几乎所有的中国和国际头部一线的汽车公司提供产品,包括宝马、梅赛德斯-奔驰、长安、大众、上汽和蔚来等。该公司2021年的全球市场份额为32.6%。截至 2021 年底,宁德时代的市值已达到 1.37 万亿元人民币(约合 2150 亿美元)。

CATL’s remarkable growth is reflected in its share price, which peaked in December last year at RMB 692 per share from the RMB 25.14 per share it was worth when it first listed in 2018. The company’s larger investors include Himalaya Capital, a fund which follows long-term value investing principles and in which Warren Buffet’s business partner Charlie Munger is an investor. Investors like this suggest that CATL will be a good value investment for some time to come.

宁德时代的显着增长体现在其股价上,从 2018 年首次上市时的每股 25.14 元人民币,到去年 12 月达到每股 692 元人民币的峰值。该公司较大的投资者包括喜马拉雅资本,这是一个长期跟进的基金,秉承长期价值投资原则,沃伦巴菲特的商业伙伴查理芒格是其中的投资者。投资者们都公开表明,宁德时代 在未来一段时间内将是一项很好的价值投资。

As of 30th September 2021, CATL Invested RMB 15.46 billion to become a limited or general partner in 75 companies, which has helped increase the CATL’s total number of patents to 2,642 in China and 196 in the rest of the world. The 75 companies are active across power batteries, energy storage, lithium battery materials, equipment manufacturing, charging, and replacement, as well as autonomous driving, electric vehicles, and even chips and semiconductors.

截至2021年9月30日,宁德时代以154.6亿元人民币成为75家公司的有限合伙或普通合伙人,使宁德时代在中国的专利总数达到2642件,在世界其他地区达到196件。这75家公司活跃在动力电池、储能、锂电池材料、设备制造、充电和替换,以及自动驾驶、电动汽车,甚至芯片和半导体领域。

CATL has become a magnet for top talent. There are currently 5,368 technicians in the company. South Korean media have reported that CATL is trying to poach people from South Korean competitors by offering three times their current salary, prompting fears of a brain drain in the Korean power battery industry.

宁德时代几乎已成为新能源行业吸引顶尖人才的磁石。公司现有技术人员5368人。韩国媒体曾经报道称,宁德时代试图通过提供三倍于当前工资的薪酬从韩国竞争对手那里挖走人才,引发了整个韩国对于动力电池行业人才流失的担忧。

BYD

比亚迪

BYD was established in February 1995 and is best known to Western observers today as an electric vehicle maker. However, BYD also plays pivotal roles in the new energy, rail transport, and electronics sectors, and has more than 30 industrial parks on six continents. It is perhaps best thought of as an OEM manufacturing company.

比亚迪成立于 1995 年 2 月,是当今西方社会最为熟知的电动汽车制造商。但比亚迪在新能源、轨道交通、电子领域也占有举足轻重的地位,在六大洲拥有30多个工业园区。一般西方国家会将其视作为 OEM 制造型公司。

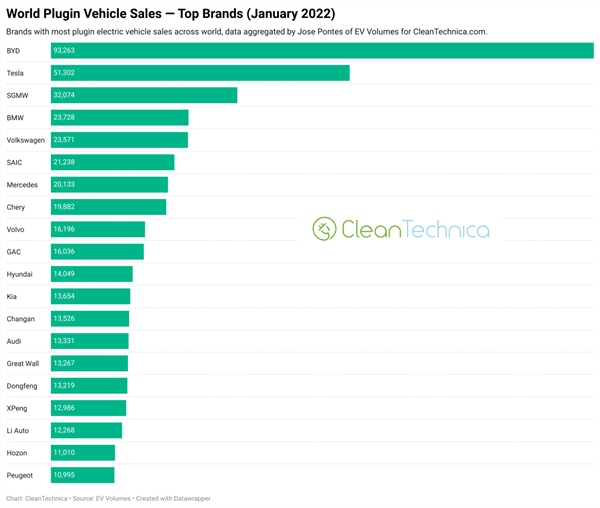

The “new energy” category of vehicles includes plug-in hybrids (PHEVs), battery electric vehicles (BEVs), and hydrogen fuel-cell vehicles (HEVs). In the global new energy sales list published in January, BYD sold the most units – at 93,263 – with Tesla in second place at 51,302. This was regarded as a notable victory for BYD, given that Tesla sells globally while BYD’s sales are limited to the Chinese market.

“新能源”汽车类别包括插电式混合动力汽车(PHEV)、纯电动汽车(BEV)和氢燃料电池汽车(HEV)。在 1 月份发布的全球新能源销量排行榜中,比亚迪以 93,263 辆的销量位居榜首,特斯拉以 51,302 辆位居第二。这被认为是比亚迪的一个重大的阶段性胜利,因为特斯拉的销售市场在全球,而比亚迪的销售数据,目前大部分还仅限于中国市场。

BYD prides itself on building a complete zero-emission new energy solution from energy acquisition and storage through to application. Its annual turnover is in excess of RMB 153 billion, and its market capitalisation exceeds HKD 600 billion. Warren Buffet’s Berkshire Hathaway holding company holds a 7.9% stake in the company – more than it owns of General Motors stock.

比亚迪以构建从能源采集和存储到应用的完整零排放新能源解决方案而自豪。年营业额超过1530亿元人民币,市值超过6000亿港元。沃伦巴菲特的伯克希尔哈撒韦控股公司持有该公司 7.9% 的股份——超过其持有的通用汽车股票。

Alongside Berkshire Hathaway, over 200 major institutional investors have invested in BYD. These include Chinese sovereign funds, China’s National Social Security Fund, China Investment Corporation (CIC), some European and Middle East sovereign funds. It also includes upstream and downstream companies in the battery and automotive industry value chains. It is reported that leading funds Sequoia Capital China, CICC, CITIC, and Himalaya have also invested significant amounts.

除了伯克希尔哈撒韦,还有超过 200 家主要机构投资者投资了比亚迪。其中包括中国主权基金、中国社保基金、中国投资有限责任公司(CIC)、一些欧洲和中东主权基金。 投资方之中,还包括电池和汽车产业价值链的上下游企业。据悉,龙头基金红杉资本中国、中金公司、中信、喜马拉雅等也进行了大量投资。

BYD is very ambitious in attracting senior talent. In recent years several executives have left first-tier OEMs to join BYD, including:

- Former General Motors (China) CEO Kevin Wale, who became senior advisor to BYD’s chairman

- Former Audi design director Wolfgang Egger

- A former exterior design director for Ferrari

- A former interior design director for Mercedes-Benz

比亚迪在吸引高级人才方面雄心勃勃。近年来,不断有国际一线公司高管加入比亚迪,包括:

• 前通用汽车(中国)CEO Kevin Wale,成为比亚迪董事长的高级顾问

• 前奥迪设计总监 Wolfgang Egger

• 前法拉利外观设计总监

• 前梅赛德斯-奔驰内饰设计总监

Refire

重塑科技

Refire produces commercial hydrogen fuel cell technologies and is the hydrogen fuel cell system supplier with the highest cumulative shipment volume in China. Their hydrogen battery technology powers over 2,700 fuel cell vehicles in China and five other countries, including Germany, Japan, and Malaysia.

Refire作为氢燃料电池技术的研发生产公司,是中国累计出货量最高的氢燃料电池系统供应商。他们的氢电池技术为中国和其他五个国家(包括德国、日本和马来西亚)的 2,700 多辆燃料电池汽车提供动力。

In the six and a half years since it was founded, Refire has sold more than 4,000 sets of hydrogen fuel cell systems in total. These fuel cell systems are main used to power city buses, vans, sprinklers, garbage trucks, refrigerated vehicles, tractors, and dumper trucks.

Since 2015 the company has increased its recruitment by more than 62% per year. Key skills the company hires for include scientific and technical research and marketing management.

成立至今的六年半时间里,Refire累计销售了4000多套氢燃料电池系统。这些燃料电池系统主要用于为城市公交车、货车、洒水车、垃圾车、冷藏车、拖拉机和自动倾斜车提供动力。

自 2015 年以来,该公司的招聘人数每年增加 62% 以上。公司招聘的关键技能包括科技研究和营销管理。

New power industries are focused primarily on R&D talent

新能源市场的人才竞争主要是研发领域

One interesting trend these three industry giants have in common is their strong focus on R&D talent, including having overseas locations in countries that also have strong R&D traditions, including Japan, South Korea, the United States, and Germany.

这三个行业巨头的一个共同趋势是,他们都非常重视研发人才,包括在日本、韩国、美国和德国等具有强大研发传统的国家/地区设立海外办事处。

At present, new energy vehicle producers are attracting mid- to high-level talent from tier-one R&D companies and departments within other China-based firms, including joint ventures. For example, most R&D personnel joined new energy firms switch from industrial motor manufacturers.

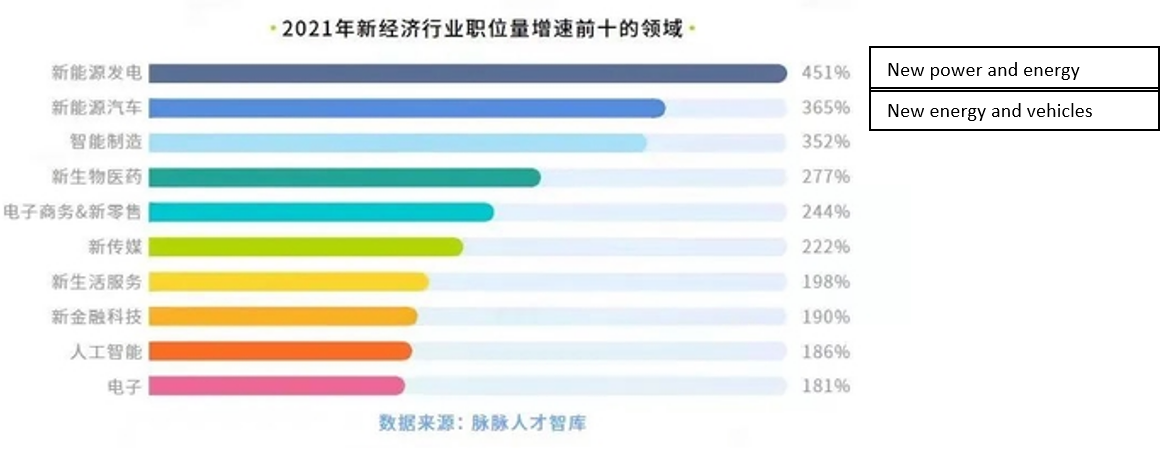

The number of new jobs in new energy vehicles almost quadrupled between 2020 and 2021 year-on-year. [See chart below – New Energy Vehicles is the second row.] Among the top 10 jobs in the new energy vehicle industry, half of them are engineers for AI and autonomous driving algorithms.

目前,新能源汽车行业正在吸引来自头部研发公司和其他中国企业(包括合资企业)部门的中高级人才。例如,大多数研发人员从工业电机制造商跳槽到新能源公司。

2020年至2021年,新能源汽车新增就业岗位几乎翻了两番。 【见下图——新能源汽车排第二】新能源汽车行业前10名中,有一半是人工智能和自动驾驶算法工程师。

Top 10 new economy sectors for job growth in 2021

The new energy vehicle companies are also proving successful in attracting R&D talent from foreign companies, such as OEM suppliers. Demand for talent is fierce and has seen salaries for top talent increase by around 45% in the new energy vehicle sector, and by around 50% in the microchip sector that supports it.

事实证明,新能源汽车公司也成功地吸引了来自 OEM 供应商等外国公司的研发人才。人才需求旺盛,新能源汽车领域的顶尖人才薪酬涨幅在45%左右,与之配套的微芯片领域则涨幅在50%左右。

Many Chinese nationals working overseas are now interested in returning to China. According to interviews with over 100 overseas Chinese executives, almost 90% would consider returning to China for a position “once the time was right”. Of these, many are in their 30s and 40s, with a high standard of education and plenty of experience. The return of large numbers of experience Chinese talent into the marketplace is bringing pressure on foreign executives in China who are not familiar with the Chinese market or who cannot speak Chinese to upskill themselves or become less competitive.

如今,许多在海外工作的中国高级人才对于回国工作,都有了浓厚的兴趣。根据对 100 多名海外华人高管做出的采访,几乎 90% 的人会考虑“一旦时机成熟”就回国工作。其中,许多人处于 30 多岁和 40 多岁,具有高水平的教育背景和丰富的工作经验。大量经验丰富的中国高级人才重返市场,给不熟悉中国市场或不会说中文的在华外籍高管带来压力,要求他们提高自己的技能或降低竞争力。