Listen to the audio version of this article (generated by AI).

Interviewed by Tom Granger, Sheffield Haworth.

Dr. Justain Bracken is a global expert in value creation, portfolio management, and digital transformation. With nearly three decades of experience across investment, consulting, and corporate leadership roles, Justain has helped steer over 60 multibillion-dollar transactions across a wide variety of sectors and regions. Most recently, he served as Executive Director of Portfolio Strategy and Digital Transformation at ADQ, a $300bn Abu Dhabi based sovereign wealth fund and holding company.

Tom sat down with Justain to explore his pivotal career moments, discuss the value of digital and AI for investors, and get his perspective on how organisations can unlock transformational value through technology, people, and strategy.

Tom Granger: Justain, thank you for joining us. To kick things off, could you tell us a bit about your background and the journey that led you here?

Justain Bracken: Thanks, Tom. It’s great to be here. I’d describe my journey as multi-dimensional and global, almost unintentionally so. I started my career at NASA and then spent the next 28 years working across public and private markets, consulting, and corporate roles, in four continents and across 12 economic sectors. I’ve led both organic and inorganic growth strategies—everything from strategy design to execution. That unplanned diversity has given me a pretty unique perspective on value creation, technology, and performance improvement. I think that perspective is what makes conversations like this so relevant.

“That unplanned diversity gave me a unique lens to look at value creation, technology, and strategy execution.”

Tom: Looking back over your career, what would you say were the pivotal career moments for you?

Justain: Getting that first job is always big, of course. But the most pivotal roles came later. One was at Nokia, where I was Chief Transformation Officer. I led a $2.2 billion EBITDA and $4 billion net cash improvement across a portfolio of 20+ businesses. It was a real masterclass in execution at scale and showed me just how powerful performance and portfolio management can be.

Then, more recently at ADQ in Abu Dhabi, a $300bn sovereign wealth fund, I led a multi-billion-dollar digital transformation across a portfolio of 40+ companies. That was pivotal because it was about more than financial returns. It was national strategy, healthcare and food security, and influencing transformation across sectors on a national level. It taught me the power of ownership, especially when you’re the majority shareholder, and how governance and policy can become additional tools for performance at scale.

“At ADQ, I learned that value creation at a national scale brings with it additional levers—like policy and sector orchestration—not just capital.”

Tom: With so much transformation under your belt, what would you say is the real value of digital and AI for investors?

Justain: Great question. I think digital and AI deliver value in two ways. First, they open up new investment themes by disrupting traditional sectors or creating entirely new digital business models. That’s the top-line opportunity.

But the second piece, arguably more powerful for most investors, is operational leverage. Digital and AI are tools for improving performance. Whether it’s revenue, margin, or cash, technology allows you to do more with less and to do it faster.

“Digital and AI offer both the spark for new ideas and the engine for performance improvement.”

Tom: Let’s dig into that a bit more. How do you approach performance improvement?

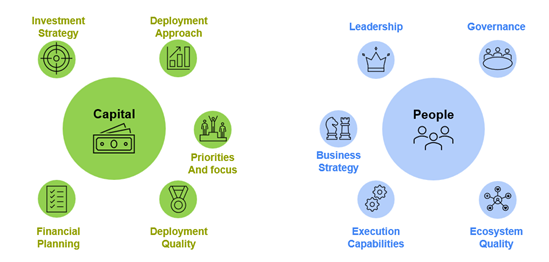

Justain: My view is that performance improvement is really about two things: capital and people. It’s about how you deploy money and how you deploy talent to create sustainable value.

From the capital side, you need to be clear on where and why you’re investing; what’s the return profile, how does it link to your multi-year strategy, and are you actively managing it?

On the people side, it’s about having strong governance, experienced leadership, and clear accountability. And when it comes to technology-led change, people matter even more. You need the right capabilities to execute, but also a culture that embraces change. Execution without adoption is just expensive noise.

“You can buy tech, but if your people don’t adopt it, you haven’t created value; you’ve just bought a toy.”

Tom: Speaking of tech, how do you define digital transformation from an investor lens?

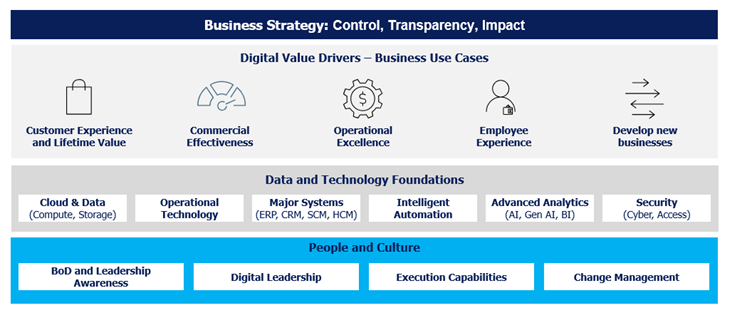

Justain: At its core, digital transformation is about evolving the business strategy and its execution. For investors, that means gaining transparency into the asset, influencing its direction, and driving impact—be that in growth, margin, or cash.

There are five main levers of value: enhancing customer experience, improving commercial effectiveness, driving operational excellence, elevating employee experience, and enabling new business models. Each of these is powered by a foundation of data and technology: cloud, intelligent automation, advanced analytics, cybersecurity, and so on.

But none of it works without people. In markets like North America and Europe, I’d say 40–50% of the effort in a transformation should be spent on change management; and a little less in other regions. Technology is the what, but people are the how.

“Most digital transformations fail not because the tech didn’t work, but because the people didn’t use it.”

Tom: In the PE world, there’s a debate around how bespoke digital strategies need to be. Do you favour playbooks or custom approaches?

Justain: I think both have their place. Playbooks are great for repeatability and scale, especially in sector-focused firms like Vista for example. But I’m a big believer in prioritisation. Not every part of a business creates value. Figure out what matters—what drives your investment thesis—and double down on that.

The playbook should help you identify where to focus and what to ignore. You don’t need to digitise everything—just the parts that give you leverage. That’s where judgment comes in. Sector, maturity, ownership model—all these factors shape what’s actually worth transforming.

Tom: Taking a step back, what’s your macro view on where digital transformation is headed and the pivotal trends?

Justain: I see four major trends. First, data is becoming a core asset, and companies are starting to protect it fiercely. No one wants to give away their competitive advantage to a tech platform that might commoditise them later.

Second, geopolitics is shaping tech. We’re moving from a single global tech stack to regional ones: US, China, and maybe others. That affects data residency, security, and vendor decisions.

Third, there’s a huge gap in adoption between B2C and B2B. B2B, especially infrastructure and critical industries, has been slower, which means there’s more room for leapfrogging.

And finally, I think we’ll see a shift from vertical tech to horizontal plays. Technologies like AI or automation aren’t industry-specific anymore. They can be applied across sectors. That changes how investors should think about scaling solutions and building platforms.

“Data is the new differentiator, and companies are becoming fiercely protective of it.”

Tom: When you’re not working on digital strategy or performance transformation, how do you unwind?

Justain: I’ve got a lot of energy, so I love being outdoors. Hiking in national parks is a favourite. I’m also a bit of a geopolitics nerd, and it helps me connect the macro with the micro in business. And most importantly, I’ve got a five-year-old daughter who keeps me grounded. Spending time with her is the best reminder that tech might shape the future, but human connection still matters most.

“Technology shapes the future, but it’s human connection that gives it meaning.”

In this edition of Pivotal Career Moments, Dr. Justain Bracken shares a powerful lens on leadership, technology, and transformation. His journey from NASA to sovereign wealth fund leadership and multibillion-dollar transformations offers timeless insights: that sustainable value isn’t just about capital deployed, but about aligning people, strategy, and innovation at scale.

Stay tuned for the next conversation in the series, where we continue exploring the defining moments and transformative ideas shaping today’s most influential leaders.

Tom is a director in Sheffield Haworth’s Technology sector practice, based in London. He is an experienced Executive Search Consultant and a Private Equity specialist. Tom has an international track record, delivering successful mandates for investors in the UK, Europe and the US. If you would like to contact Tom to talk through any of the themes discussed, please email t.granger@sheffieldhaworth.com